Table Of Content

- Does Covid-19 Passenger Tragedy Make Carnival Stock A Buy Right Now? Here's What Earnings, Charts Show

- Our Services

- The Cruise Line's Technical Ratings Are Weak

- Should You Buy Carnival Stock Before It Goes Back Up?

- Carnival History and Stock Performance

- Could Carnival Cruises Be a Millionaire Maker Stock?

Beyond a suite of new tech it will also be the first cruise ship with an actual roller coaster. Carnival's new ship is going to turn heads, but investors are used to roller coasters. Carnival was a wild white-knuckled ride in 2020. It's too early to say if Carnival will indeed bring all of its ships back to the seas this year.

Does Covid-19 Passenger Tragedy Make Carnival Stock A Buy Right Now? Here's What Earnings, Charts Show

IBD's proprietary RS Rating ranges from 1 (worst) to 99 (best), and measures a stock's price performance in the past 12 months against all other stocks. When investors are looking for top stocks to buy, they want to see a stock shaping a proper chart pattern. IBD's long-term research shows that certain chart patterns are the launchpads that kick off virtually all major stock moves. Carnival also has made efforts that will help its earnings into the future.

Our Services

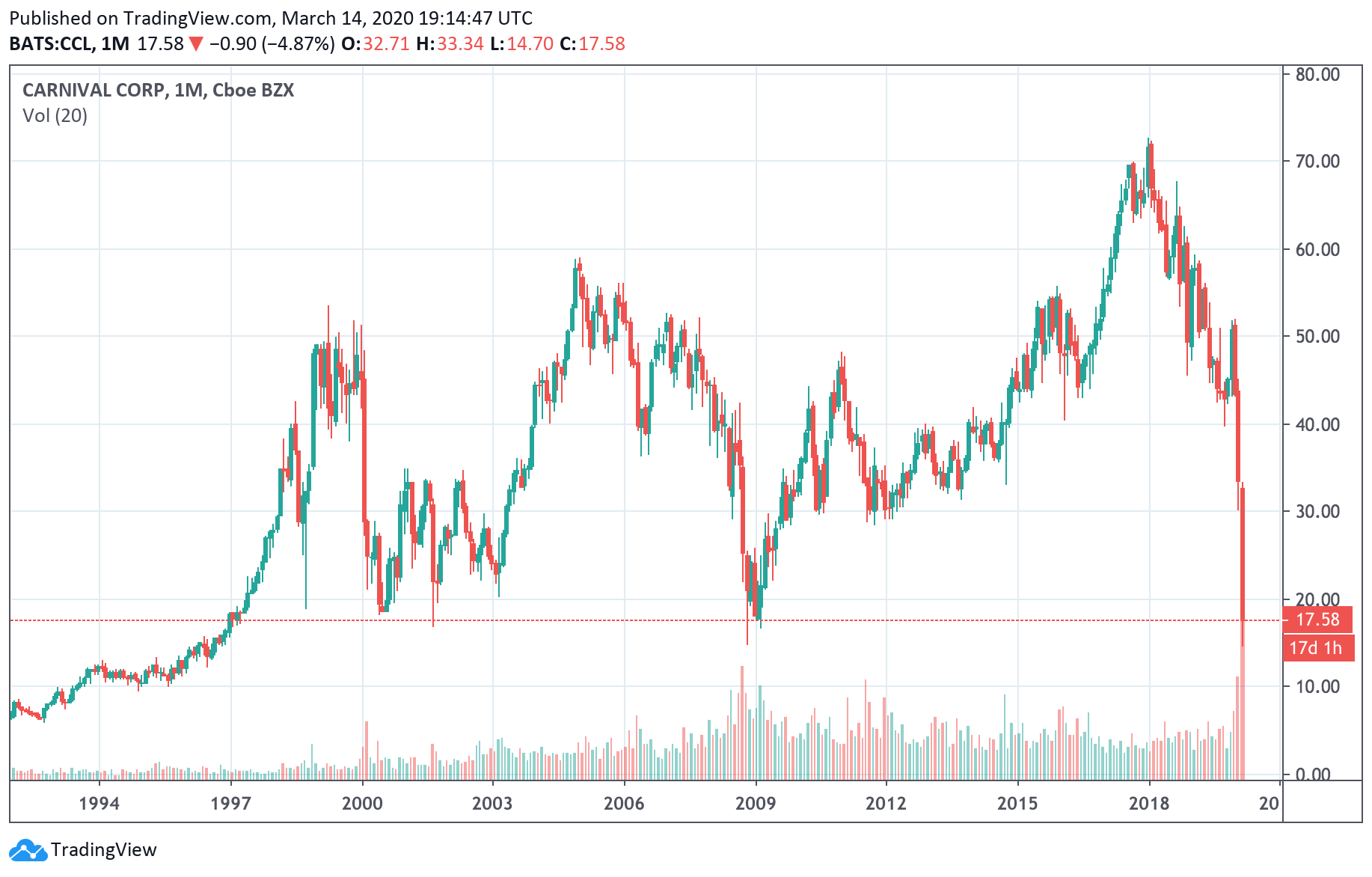

CCL stock went up, then down, amid news that a passenger aboard Carnival Vista who had tested positive subsequently died. Vista, out of Galveston, is owned by the namesake cruise line of Carnival Cruise Line (CCL). The world's largest cruise line operator is a roller coaster ride in more ways than one. Carnival said it hopes to have all of its remaining ships back in service by the end of 2021. If vaccination efforts take longer than planned and the crisis lingers, Carnival might not meet that goal. You can buy Carnival Corp. stock now if you already have a funded stock brokerage account with a broker that has access to buy NYSE traded stocks.

The Cruise Line's Technical Ratings Are Weak

Still, Carnival remains a risky stock because we don't know when the coronavirus pandemic will ease and therefore when the ships will sail again. If things improve quickly, Carnival's shares may rebound this year. If they don't, investors will have to be patient.

Carnival Stock Gains as Company Posts Record Revenue, Cheery 2024 Outlook - Investopedia

Carnival Stock Gains as Company Posts Record Revenue, Cheery 2024 Outlook.

Posted: Thu, 21 Dec 2023 08:00:00 GMT [source]

Departures from U.S. ports essentially ground to a halt in March 2020. Vaccinated passengers must show proof of a negative Covid-19 test taken within three days of departure. They added, "Belize's tourism and health officials remain vigilant in order to maintain safety for all stakeholders, bearing in mind the delicate balance between health and the economy." But news of her passing has emerged only recently. Shares of Carnival Corporation & plc CCL have rallied 42.5% in the past year compared with the industry’s 11% growth.

Carnival is requiring passengers to be vaccinated against the virus unless they are under 12 years old or have a medical excuse. The insurance would kick in if the passengers have to leave a ship because of Covid-19. At the moment, government regulatory agencies have granted emergency authorization to administer the Pfizer and Moderna vaccines in the U.S., the European Union, and several other countries.

Norwegian Cruise Line Earns Relative Strength Rating Upgrade

The passenger reportedly was Marilyn Tackett, age 77. She was one of 27 people aboard Vista who tested positive. All 26 of the other positive tests were among crew. Proceeds from the offering of senior unsecured notes and cash on hand to be used to redeem €500 million 7.625% senior unsecured notes due 2026; cash on hand to...

Have they looked at the per-share projections? Carnival is not a millionaire maker stock in the near term, and only investors with a long-term mindset should be boarding right now. It's not just the fuel source that will make Mardi Gras different when it takes on its first passengers in April or later this year.

Mardi Gras will be the first in Carnival's fleet powered by liquefied natural gas, a more environmentally friendly and right now cheaper energy source than heavy fuel oil or marine gas oil. So, yes, buying shares of Carnival before they go back up is a good idea. That's only a good idea if you're an aggressive investor who can handle a lot of risk and is willing to be a little patient. Countries are beginning to immunize their citizens, using recently approved COVID-19 vaccines. And the Centers for Disease Control and Prevention (CDC) last fall issued a Framework for Conditional Sailing Order -- guidelines to bring ships and their passengers back into operation. No matter what, Carnival remains the leader in its industry, and its stock has recently sold off significantly.

We'll also have to hope that Carnival can continue to manage its cash levels and control cash-burn rates. Those are key points to watch in upcoming earnings reports. Carnival management, in a fourth-quarter earnings conference call, said the cruise line hasn't yet set a date for test cruises -- a requirement under the new CDC order. Test cruises involve sailing with volunteer passengers to confirm the efficacy of new health and safety measures aboard ship.

This could present an opportunity for a long-term investor or trader willing to pick up some stock on dips. It suffered losses due to the 2020 pandemic and may continue to see losses. CCL stock carries a low 6 for its Earnings Per Share Rating.

It is also recommending that passengers show both negative tests and proof of vaccinations. Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned m... Carnival (CCL 1.13%) (CUK 1.65%) took delivery of its newest vessel, Mardi Gras, last month, and it won't be just another cruise ship.

Long-term debt has ballooned, nearly doubling from $9.7 billion to $18.9 billion in that time. Carnival and its peers did what they had to do to survive in 2020 and beyond. They raised billions apiece through stock offerings at low price points and debt at high interest rates. You can't blame them for panhandling in the middle of a storm. Even after trimming its operations and unloading some of its ships, Carnival is still burning through $530 million a month. If you're bullish on Carnival's long-term prospects, I'm with you.

Mass vaccinations are key to slowing the spread of the virus and helping convince the general public it is safe to once again move about freely. It opens the door to the potential for cruising in the near future. This is an improvement from the CDC's No Sail Order, which was issued last spring.

No comments:

Post a Comment